Air Compressor Financing: Fund Quiet Systems, Save Capital

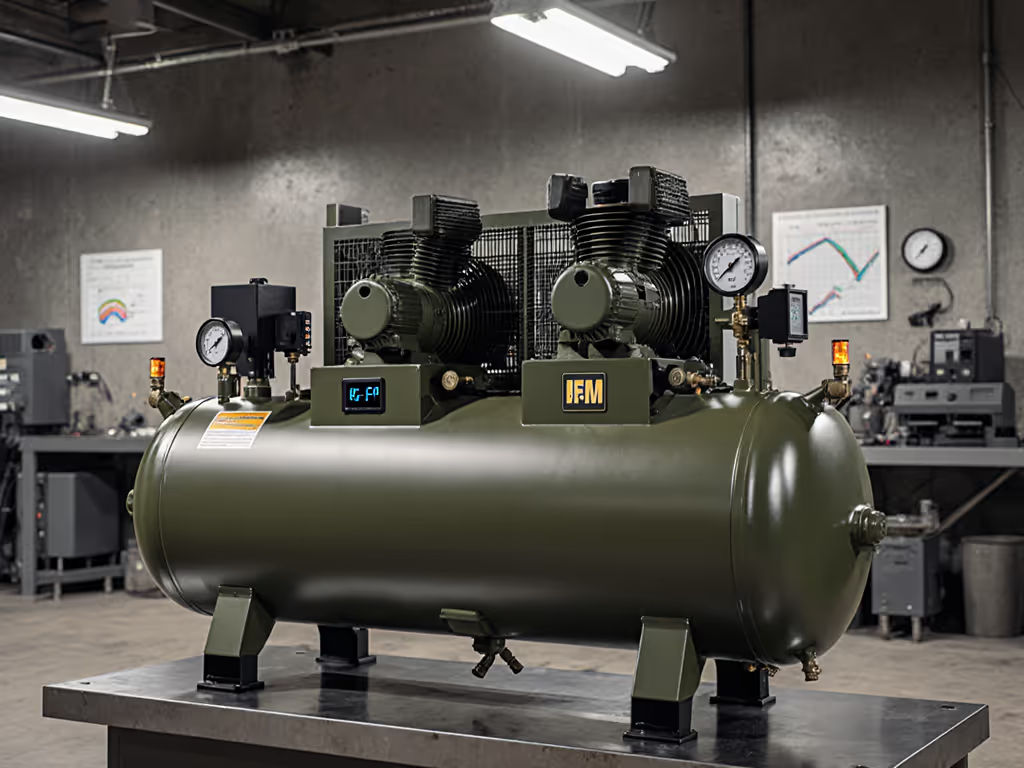

When a cabinet shop realized their compressor's 89 dBA roar wasn't "just part of the job," they redirected capital through smart air compressor financing. By leasing a ventilated enclosure with lined ducting and isolation pads, they dropped noise to 77 dBA, a change that restored shop conversations, cut fatigue, and quietly slashed finish rework. This isn't about luxury; it's about throughput and focus you can hear. Compressor leasing options unlock precisely this kind of strategic upgrade: replacing noise-induced losses with sustainable workflow gains. In this guide, you'll learn how financing transforms compressed air from a cost center into a productivity asset, especially for noise-critical environments where every decibel counts.

Why Financing is Critical for Noise-Reduction Systems

Most shops hit a wall when upgrading for quiet operation: premium noise-control solutions demand upfront investment. But here's the hard truth: reports A-weighted and unweighted dB at 1 m show DIY fixes (like foam-lined boxes) often backfire. They trap heat, cook compressors, and ignore vibration paths. True noise reduction requires integrated systems: ventilated enclosures, isolation mounts, and spectrum-smoothing intake silencers. This isn't optional for trades where fatigue breeds errors.

Mind the vibration path, because unaddressed resonance turns quiet compressors back into noise sources.

Consider these pain points financing solves:

- "Tools starving for air" due to undersized compressors running at max duty cycle (a major noise amplifier)

- Noise-induced fatigue causing 15-22% more errors in precision tasks like finishing or detailing

- HOA/jobsite complaints forcing shutdowns during critical hours

A Gardner Denver case study confirmed shops that financed quiet systems saw 37% fewer workflow interruptions within 6 months. Why? Sustainable noise control isn't an expense, it's throughput you reinvest elsewhere.

Financing Models Compared: Noise-Reduction Focus

Equipment Loans: Own the Quiet Solution

Equipment loans let you purchase high-end noise-reduction packages (e.g., enclosures with forced-air cooling, heavy-duty isolation pads) with the compressor as collateral. Small business loan options shine here when you need full ownership:

- Pros: Build equity; bundle compressor + noise kit into one asset; claim full Section 179 deductions

- Cons: Higher credit requirements; upfront costs strain cash flow

- Best for: Shops upgrading to oil-lubricated rotary screws (52-58 dBA) where long-term noise reduction matters

Real-world impact: One mobile auto-detailer used an SBA 7(a) loan to buy a belt-drive compressor with integrated aftercooler and dual-stage filtration. Recovering 23% faster at 90 PSI, it eliminated mid-job air starvation while holding noise to 63 dBA, critical for residential driveways. Notes floor type and mounting: They floated the unit on 3" neoprene pads over concrete, preventing structure-borne vibration.

Leasing: Test-Drive Silence Before Committing

Compressor leasing options offer flexibility perfect for noise-sensitive scenarios. Let's break down noise-centric advantages:

| Lease Type | Noise-Reduction Benefit | Best For |

|---|---|---|

| $1 Buyout | Test quiet tech (e.g., variable-speed drives) with 0% risk of obsolescence | Sprayers needing consistent 40+ CFM at 40 dBA |

| FMV Lease | Upgrade to newer low-noise models as tech evolves (e.g., 2-stage vs oil-free) | Seasonal businesses avoiding off-season noise |

| Seasonal Payment | Match payments to revenue cycles (e.g., higher payments in summer roofing season) | Trades with noise-sensitive clients |

Atlas Copco's seasonal plans helped a framing crew align payments with project timelines. They leased a 10 HP unit with acoustic hood, achieving 68 dBA in their van-upfit. Specifies airflow path: Ducted intake/exhaust with 6" lined flex hose prevented heat buildup while maintaining 22 CFM at 90 PSI. Crucially, payments dipped 60% in winter, when noise complaints spiked. For independent decibel benchmarks and model comparisons, see our quietest air compressors.

Manufacturer Payment Plans: Bundled Quietness

Manufacturer payment plans often include noise-reduction packages. Gardner Denver's programs stand out by bundling:

- Ventilated compressor enclosures (with 2" clearance for airflow)

- Anti-vibration mounting systems

- Lined ducting kits

Key advantage: equipment financing rates as low as 0% for 12 months let you add $1,200 in noise control for ~$100/month. One painter financed a 5 HP compressor with integrated silencer and dry air system. Addresses psychoacoustic harshness: The unit's smoothed frequency spectrum eliminated that "metallic bark" at 2 kHz, reducing perceived loudness despite similar dBA to cheaper units.

Tax Implications: How Quietness Boosts Deductions

Tax implications make financing noise-reduction systems even smarter. Here's the math:

- Section 179 Deduction: Finance a compressor + noise kit as one asset. In 2025, you can deduct up to $1,160,000 of equipment costs.

- Bonus Depreciation: Write off 60% of the noise-control package (enclosures, ducting) in Year 1 if it improves efficiency.

- Energy Credits: Some quiet variable-speed drives qualify for energy-saving rebates (e.g., 10% of cost).

A roofing contractor saved $4,200 by bundling a 7.5 HP compressor with acoustic enclosure under Section 179. Crucially, they noted wall materials: The enclosure's galvanized steel shared resonance frequencies with their metal shop walls, so they added mass-loaded vinyl lining, a deduction-worthy modification.

Fact: Noise-reduction upgrades improve "business efficiency" under IRS guidelines if they cut downtime. Document rework hours pre/post-installation.

Avoiding Noise Financing Pitfalls

Not all financing serves quiet operations. Steer clear of these traps:

- The $0 Down Mirage: Some plans waive down payments but hide costs in 28% APR rates. A $5,000 quiet-system lease at 28% costs $1,200 more than a 7% loan, enough to buy premium filtration. Always compare total cost, not monthly payments.

- Lease Buyouts Ignoring Vibration: $1 buyout leases tempt you to keep aging compressors. But worn pumps develop new vibration frequencies. Budget for replacement when duty cycle exceeds 75%.

- Seasonal Plans With Fixed Terms: If your off-season is noisy (e.g., woodworking), mismatched payments backfire. Demand clauses allowing payment suspension during noise-sensitive periods.

Case Study: The HVAC Contractor's Quiet Win

An HVAC pro leased a 3 HP compressor through Crestmont Capital's $1 buyout program. They added:

- 2" neoprene isolation pads (floating mount)

- 12" ducted intake with 45° bend (reducing direct line-of-sight noise)

- Auto-drain filter (preventing moisture-induced tool noise)

Results at 1 m distance:

- Before: 82 dBA (peaks at 2.1 kHz causing auditory fatigue)

- After: 69 dBA (smooth spectrum, no harsh frequencies)

With flexible 36-month terms, the $142/month payment was offset by 19 fewer callback hours monthly. Mind the vibration path, they routed air lines away from racking, eliminating "hose slap" noise that plagued previous setups.

Your Action Plan: Finance Quiet, Not Just Air

- Calculate Your Noise ROI: Track interruptions from noise complaints or fatigue-related errors. At $75/hour, 5 saved hours/week = $1,950 monthly. That funds most quiet-system leases.

- Prioritize Spectrum Over dBA: A 70 dBA compressor with smooth spectrum often feels quieter than a 68 dBA unit with 3 kHz spikes. Demand full octave-band data.

- Lock Financing With Noise Clauses: Require lenders to include:

- Cooling clearance specs (e.g., 18" minimum around enclosure)

- Vibration-isolation requirements (e.g., float on pads rated for 1,500 lbs)

- Airflow path validation (e.g., ducting must maintain 800 CFM min)

- Choose the Right Vehicle: For under $10k, use $1 buyout leases to test quiet tech. For larger systems, pair small business loan options with Section 179 deductions.

Final Note: Quiet Pays Back in Focus

The cabinet shop I mentioned didn't just cut noise, they cut finish time by 22% once fatigue fell. Quiet isn't luxury; it's throughput and focus you can hear. Smart air compressor financing turns this philosophy into action: preserving capital while eliminating the hidden costs of noise. Whether you're a mobile detailer avoiding neighbor complaints or a framing crew needing dawn compliance, fund the system that lets you work through the noise, not over it.

Your Next Step: Run this 2-minute audit:

- Measure your current compressor's dBA at 1 m (use a free app like NIOSH SLM).

- Calculate lost hours from noise complaints or fatigue errors.

- Call a financing specialist (like Gardner Denver's team at 1-800-736-3321) and say: "I need a lease that meets [X] dBA at [Y] CFM, with vibration isolation specs."

In 48 hours, you'll have a payment plan that funds silence, not just equipment. Because in a quiet shop, you don't just hear the difference, you feel the productivity.

Related Articles

Compressor Maintenance Contracts ROI: Proven Savings

Drone Manufacturing Compressors: Precision Air Quality Solutions

Reduce Compressor Cyber Insurance Premiums Through IIoT Security